what is limited fsa health care

A Limited Expense Health Care FSA LEX HCFSA is used in place of the general purpose Health Care FSA if the participant enrolled in a High Deductible Health Plan with a Health Savings Account HSA. These accounts are typically combined with a health savings account HSA to help families increase their healthcare savings during the year.

A Guide To Open Enrollment That Won T Make Your Head Spin

Check the Newest Plan Options.

. Over 1 million doctors pharmacies and clinic locations. An HSA offsets the expenses of a high deductible plan and provides savings for any out of pocket OOP health. Limited-Purpose FSA Eligible Expenses You can use your Limited-Purpose FSA to pay for a variety of dental and vision care products and services for you your spouse and your dependents.

4 Depending on your employers plan you may carry over up to 20 percent of that plan years maximum health FSA salary reduction. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. Easy implementation and comprehensive employee education available 247.

Free 2-Day Shipping with Amazon Prime. The IRS created this rule which states that all money left in your FSA is forfeited after the. Ad 247 virtual care.

Health Care FSA and Limited Purpose FSA. An HSA is both a health care account as well as a savings account. The IRS determines which expenses are eligible for reimbursement.

Ad Custom benefits solutions for your business needs. The IRS may request itemized receipts to verify the eligibility of your expenses. Ad Join 2 Million Satisfied Shoppers weve Helped Cover.

An employees yearly FSA allocation is available in full on the first day of the plan year regardless of contributions to date. The LPHC FSA is compatible with an HSA. A limited purpose FSA is a.

It functions like a GPHC FSA but cannot be used for medical or prescription drug expenses. 16 rows Please save your receipts and other supporting documentation related to your LEX HCFSA expenses and claims. Credit card receipts canceled checks and balance forward statements do not meet the requirements for acceptable documentation.

If youre enrolled in a qualified high-deductible health plan and have an HSA you can maximize your savings by pairing your HSA with a Limited Purpose Flexible Spending Account FSA. Unlike a regular health FSA this employer. Affordable Healthcare Coverage for Families Individuals.

When you get medical treatment in-network the. What is the use-it-or-lose-it rule. The Limited Expense HCFSA allows you to submit eligible dental and vision expenses only.

An EPO plan is a type of health insurance that helps pay for medical care but only if its from doctors and hospitals within the plans network. Limited Expense Health Care FSA Eligible Expenses Vision exams LASIK surgery contact lenses and eyeglasses. A limited-purpose flexible spending account LPFSA is a pretax account only available to employees enrolled in a qualified high-deductible healthcare plan HDHP.

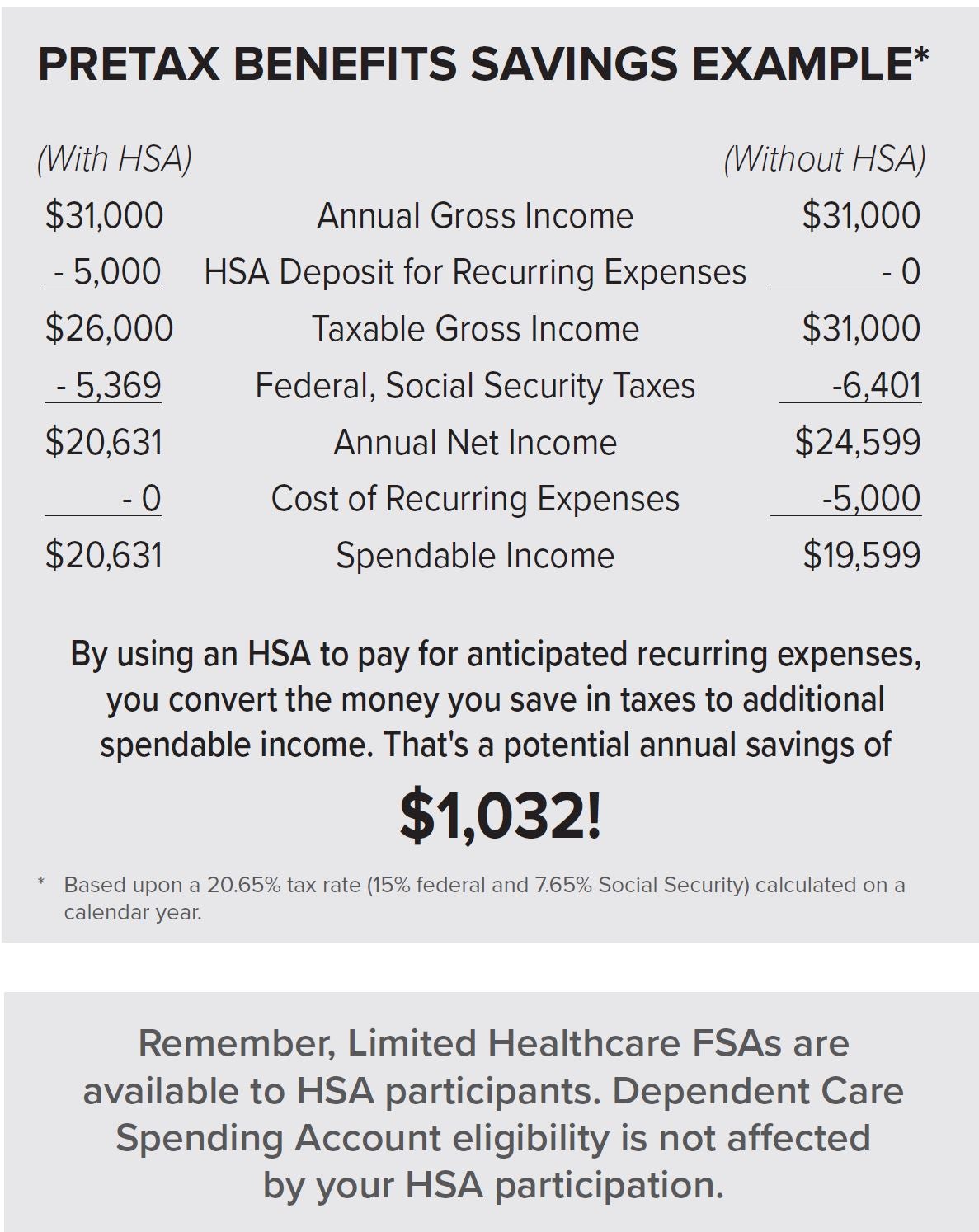

Elevate your health benefits. This means youll save an amount equal to the taxes you would have paid on the money you set aside. With a Limited Expense Health Care FSA you use pre-tax dollars to pay qualified out-of-pocket dental and vision care expenses.

Ad Save on fsa and hsa approved items. Do you need an FSA. 24-hour nurse help line and a team of medical experts.

A health care FSA can be useful for people with any. What is a Limited Expense Health Care FSA. Walk-in care options nationwide.

The money you contribute to this account is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck. Limited Purpose Flexible Spending Arrangement LPFSA. An employee benefit that lets workers set aside pre-tax dollars to pay for qualified dental and vision expenses.

What is a limited purpose flexible spending account. What is a Limited Purpose Health Care FSA LPHC FSA. Get a free demo.

You dont pay taxes on this money. Dependent Care Flexible Spending Account. Designed only for submitting eligible dental and vision expenses the Limited Expense HCFSA is used as a replacement for the old good HCFSA when the participant owns a High Deductible Health Plan with an HSA.

A limited-purpose FSA is similar to a general purpose FSA except that qualified medical expenses are limited to eligible dental and vision costs. A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA. Dental cleanings X-rays fillings crowns and orthodontia.

This is so because the IRS doesnt allow for the HSA participants to participate as well in. A limited-purpose FSA can cover certain dental and vision care expenses while an HSA can cover broader health care costs. An employee may only use the funds that are available in.

An LPHC FSA is used to pay out-of-pocket dental and vision eligible expenses not covered by insurance. Limited Expense Health Care FSA Eligible Expenses. LPFSAs are accounts that let you use pre-tax dollars to pay for qualified dental and vision expenses.

Get a Quote Now. Is limited FSA use it or lose it.

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

Have Your Self Care Plan Set For The Year 2020 Selfcare Yonisteaming Yonisteamatl Yonisteamingatlanta Stockbridge Hsa Foot Detox Yoni Steam Care Plans

Health Care Provider Code Qf4ksz Health Care Coding Oral Health Care

Health Insurance 101 Hsa Fsa Hra Life And Health Insurance Health Insurance Plans Health Savings Account

Hra Vs Fsa See The Benefits Of Each Wex Inc

Limited Purpose Fsas Combining Hsas And Fsas Infographic

Navia Benefits Limited Health Care Fsa

Navia Benefits Limited Health Care Fsa

Health Savings Account Human Resource Services

2021 Year Planner Hra Consulting Photo Calendar Template 2022

What Is An Limited Purpose Fsa And How Account Holders Can Use It

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Health Insurance Agents Recruitment

Get Convatec Visi Flow Irrigator With Stoma Cone Use Fsa Stoma Irrigation Control Flow